The Three Lives of Three Mile Island

The story of America’s most notorious nuclear power plant continues thanks to demand from Big Tech. “It’s time to believe!”

The first life of Three Mile Island Generating Station ended with a shock. In 1978, when Unit 2 was commissioned, the Atomic Age’s enthusiasm had already begun to fade. Nuclear energy, once hailed as the future, was increasingly met with unease.

The movie “The China Syndrome”, a story about a fictional nuclear meltdown captured this nebulous mood. Improbably, mere weeks after the movie opened, Three Mile Island Unit 2 suffered a partial meltdown on March 28, 1979 caused by a cooling malfunction.

The news reaction and pop-culture footprint of the TMI-2 was wholly disproportionate to the actual seriousness of the incident. TMI-2 was destroyed, and a small amount of radioactive gas was released into the atmosphere. There were no injury or deaths, and subsequent follow-up showed no lingering health effects for nearby residents. Nevertheless, the incident allowed the previously vague anti-nuclear sentiments to coalesce and solidify.

Low-key Second Act

The second life of Three Mile Island is a reflection of American Nuclear in the post-atomic age. It’s a story of humble improvements, operational excellence and Public Relations blackout. Even as an avid pro-nuclear activist, I was unaware that Three Mile Island Unit 1 quietly continued to operate until 2019.

After the TMI-2 accident, the U.S nuclear industry faced a reckoning. Like all nuclear plants in the U.S., TMI-1 had to meet stricter safety standards from the Nuclear Regulatory Commission (NRC). Paradoxically, these stringent measures lead to an operational excellence that surpassed all expectations. By the time TMI-1 returned to service, it was achieving a 74.1% capacity factor — a significant improvement. By 1994, it became one of the first reactors to achieve a three-year average capacity factor of over 90%, a milestone that subsequently became standard across the industry in the U.S.

Despite these operational successes, a new threat emerged: cheap shale gas. By the late 2010s, nuclear plants across the U.S. struggled to compete with the plummeting costs of natural gas, and TMI-1, a single-unit plant with no twin to share costs, was hit especially hard. Unable to compete with gas generation units powered by cheap shale, TMI-1’s owner Exelon Energy (now Constellation Energy) threw in the towel and TMI-1 powered down in 2019. It seemed like the end of the road for Three Mile Island…until now.

Tech’s change of heart and TMI’s Third Act

The third life of Three Mile Island is now unfolding, driven by an insatiable demand for stable, low-carbon electricity to power the tech sector, especially related to Artificial Intelligence. In a deal that would have been unthinkable just months ago, Microsoft has partnered with Constellation to restart TMI-1 by 2028 to power its data centers. Microsoft will be the sole offtaker for all the power the 880-MW reactor will generate. This guaranteed 20-year agreement makes the $1.6 billion price take to bring TMI-1 back to life worth it for Constellation*

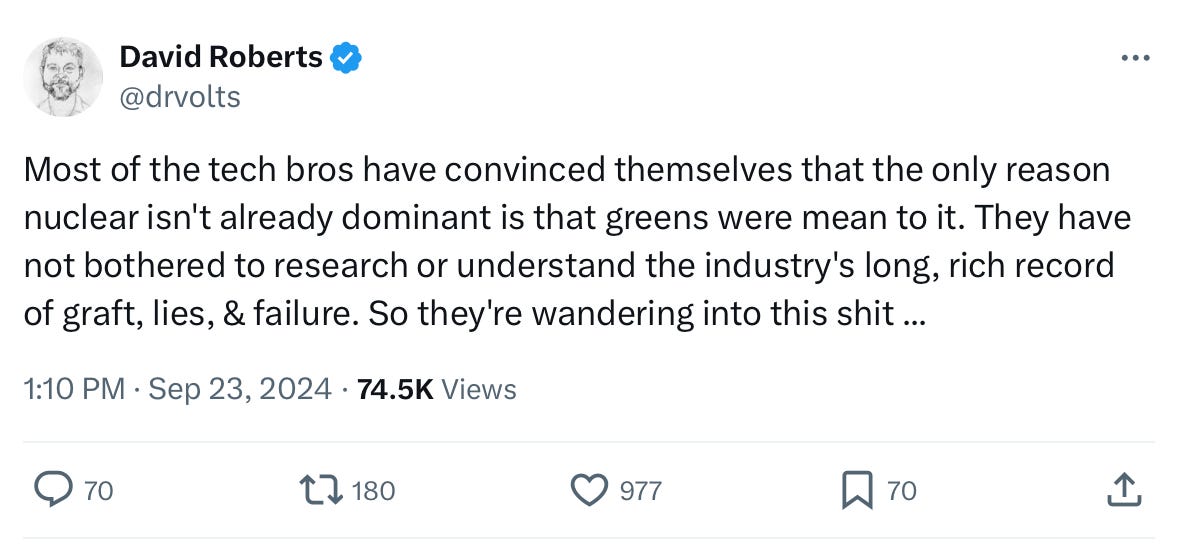

Not everyone is convinced this is the right move. Some renewable advocates like Dave Roberts of Volts see Big Tech’s newfound enthusiasm of nuclear as shortsighted and naive.

“Most of the tech bros have convinced themselves that the only reason nuclear isn't already dominant is that greens were mean to it,” Roberts argued, critiquing the tech industry’s supposed lack of understanding of the nuclear industy’s “long, rich record of graft, lies, & failure.”

But this narrative doesn’t square with the fact that until recently, tech companies were strong advocates of renewable energy, pouring resources into RECs and ambitious decarbonization goals only on “green”. As Mark Nelson of the Radiant Energy Group pointed out, “The richest companies in the world were pushing ‘100% renewables’ extremely hard, right up to running out of baseload electricity.”

“They watched nuclear plants die rather than lift a finger to help. Not anymore.”

The best explanation of this sea-change came from Danielle Fong: “AI flips electricity on its head.”

“The capital cost of the power infrastructure is just a tiny fraction (like 3%!) of the capex of the compute, and even just the depreciation of the compute exceeds the cost of even premium power,” explained Fong, a silicon-valley based inventor, “Hence, AI hyperscalers are traveling to where the power is, are building where power has been and are getting into the business of actually building powerplants and reactors.”

From Dubai to New York

I was there in Dubai for COP 28 as 22 nations pledged to triple nuclear. I was also there last week in New York City for Climate Week 2024, where 14 banks including huge players like Goldman Sachs, Citi, BNP Paribas, Morgan Stanly and Bank of America expressed their support for that pledge. Ironically, while both COP28 and NYC Climate Week were big decarbonization confabs, both pushes to break for nuclear were spurred by demand for actual electrons: the European energy crisis of 2022 and Big Tech demands respectively.

While no money is put on the line, it’s a signal to electric utilities that these banks who own a lot of their debt are in favor of nuclear power. This assuages the fear that a utility’s stock might be downgraded if they announced a new nuclear plant.

It feels like the nuclear snowball that started rolling in Dubai is gathering momentum fast, and the TMI deal is critical to that momentum, explained the Loan Program Office’s Jigar Shah on the Odd Lots.

“I would say up to two weeks before this announcement around the restarting of the Crane Clean Energy Center, a lot of folks were like, I don’t know how the stock market is going to react to this.”

“Crane Clean Energy Center,” by the way, is the new name of TMI-1. And now let’s take a look at exactly what happened to Constellation’s stocks after that announcement.

Constellation soared to an all-time high, jumping around 15 percent on the news. It’s more than doubled this year as well.

“Now, they’ve got the validation,” said Shah, “it’s time to believe.”

THE ELEMENTAL TAKE

After TMI, what’s next? The existing stock for restarts and even finishing halted construction in the US is very thin. Duane Arnold in Iowa (restart) and Bellfonte in Alabama (halted construction) comes to mind. That’s it for the low-hanging fruit…nowhere near enough.

The next level up in challenge is building new reactors from scratch, but on existing sites where nuclear power is already working. As Shah reminded us, there are a lot of sites made for four or five reactors that only have one or two reactors on it right now. There’s a rich seam of possibilities for such a buildout and time will soon tell if the current support of fat PPAs from tech combined with IRA tax credits would be enough.

If so, we can look forward to a new buildout of big reactors in the United States none of us — including me — dared imagine just months ago.

While most of the interest centers around the AP1000 for good reason — it’s an excellent design and validated by the Vogtle builds — I can’t help but wonder if GE Vernova has been paying attention for the new interest in Big.

GE Vernova previously trimmed its efforts in the nuclear market to the 300MW BWRX-300. According to the TVA’s latest costing, the First of a Kind costs for the BWRX-300 might come in at an eye-watering US$17,949/kW for a 2033 completion. That works out to more than US$5 billion per 300MW reactor. For that price, Japan was churning out full-sized Advanced Boiling Water Reactors (ABWRs) with capacity of up to 1,400MW.

While it is unreasonable to expect 2024 US new-builds to match pre-Fukushima Japan builds dollar for dollar and to compare FOAK to NOAK, we’re talking about building a reactor less than 1/3rd the size for the cost of a full reactor.

Now that jumbo-sized demand is back, it may be reasonable for GE Vernova and their partners TVA to investigate whether it might be appropriate and cost-effective simply to bring the full-sized ABWR to the US and save the excellent but expensive BWRX-300 for use cases where 300MW is truly all that is required.

Nice summary article, Angelica

TVA's report is pretty damning. Assuming they refer to the BWRX-300 for SMRs, at this FOAK/NOAK cost it keeps none of its promises. Pretty disheartening, really. This puts a ? over the European BWRX-300 plans for me as well.